Introduction

Executive summary

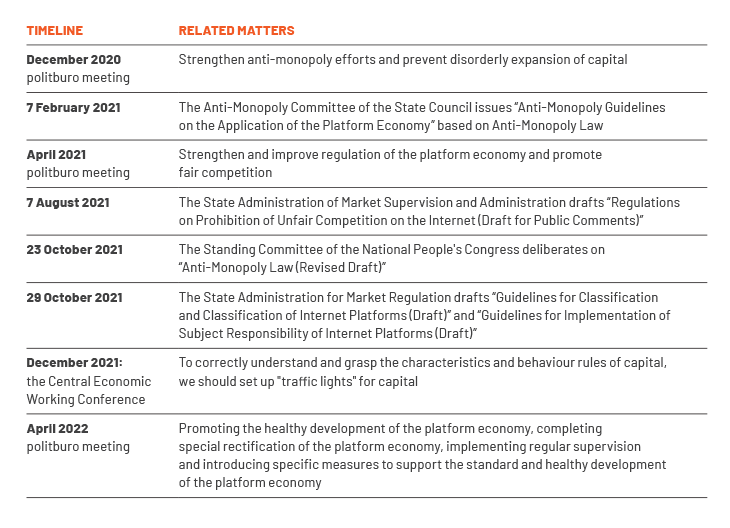

From 2020 to 2021, the Chinese state implemented a series of legal system improvements and severe administrative penalties for malicious competition and monopolistic practices in the platform economy. For some leading internet companies, the past two years have been filled with pain and fear. Each platform has tried to get a slice of the cake, and this storm of competition has gradually cooled down. This paper focuses on why the state is regulating the platform economy so strictly and how it will likely evolve.

Introduction

Imagine a normal working Chinese citizen’s day: wake up early, use DDT (a ride-hailing app) to take a taxi to office, pay through WeChat, find inspiration for lunch through Meituan (a food delivery app), browse Alibaba's Taobao after work or share interesting information on short video platforms. Our lives are already closely connected to the major platforms, and continued public consumption is driving profitability and growth of the major platforms.

Evolution of platform companies

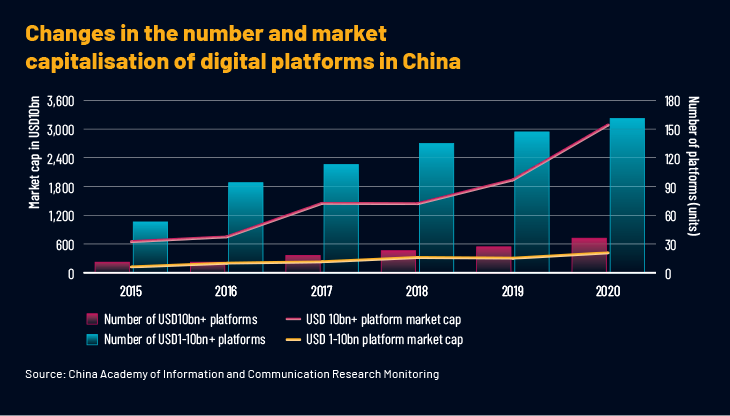

In the decade after 1999, the emergence of two e-commerce giants, Taobao and Jingdong, set off China's online shopping boom. From 2008 to 2015 was a period of rapid growth for the platform economy, during which Taobao set off the “Double 11” shopping frenzy, while Meituan, founded in March 2010, continued to promote the digitalisation of the demand and supply sides of service and goods retailing. The year 2012 saw domestic travel giant "DiDi" also set off a wave of online taxi platforms. From 2015 to 2022, the number of mid-size platforms nearly tripled, and the market capitalisation of both large and mid-size platforms nearly more than tripled.

Key Challenges

With the entrance of more and more small and medium-size enterprises and full coverage of the network, competition for customer traffic seems to have reached a bottleneck. To preserve their position in the sector and market share, platform companies’ irregular development and monopolistic behaviour become more rampant.

Government intervention

As the maturity cycle of the platform economy sector shortens, the state letting the platform economy develop without intervention would lead to a situation of "the strong getting stronger and the weak getting weaker". Therefore, starting from 2020, especially in 2021, the platform economy entered a stage of rectification and governance.

Future outlook

After more than one year of national legal system adjustment and serious punishment, the operation of digital platforms will likely be more manageable than before. Leading internet companies would follow the rules of market competition more closely, creating more opportunities and space for SMEs to grow. Meanwhile, due to the recurring infections, the sluggish national economy needs the support and help of the platform economy.

Conclusion

The platform companies are immensely important to China. The intense completion has led to unethical practices in the space but the country has proposed a series of policies to support and encourage the development of the platform economy and to use digital platform companies as an important channel to boost the national employment rate. In a perfect legal system and benign competition environment, the platform economy will likely continue to develop and achieve a quantitative to qualitative leap.

Acuity’s Value proposition

We have been serving in Beijing for more than a decade, and our talent pool of bilingual analysts can help investors monitor the sector, translate policy documents, prepare sector and company reports and build financial models. They act as an extension of our global clients’ research teams and keep money managers abreast of developments in China through meaningful and bespoke research.